Orphan Drugs Market to Reach USD 486.51 Billion by 2032 on Rare Disease Focus | DataM Intelligence

The orphan drugs market will grow from $223.76 Bn in 2023 to $486.51 Bn by 2032 at a 9.1% CAGR, spurred by new funding in the US and Japan.

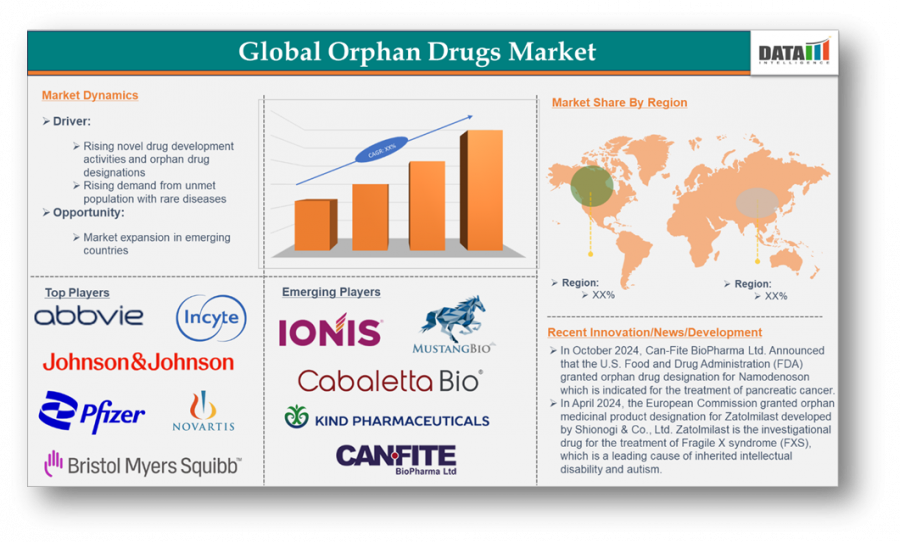

GEORGIA, GA, UNITED STATES, July 28, 2025 /EINPresswire.com/ -- Orphan drugs, which are treatments developed for rare diseases impacting limited patient populations, have emerged as a key area of innovation and investment in the biotech sector. Based on analysis by DataM Intelligence, the global orphan drugs market was valued at USD 223.76 Billion in 2023 and is projected to grow significantly, reaching USD 486.51 billion by 2032, with a compound annual growth rate (CAGR) of 9.1%.

Download exclusive insights with our detailed sample report (Corporate Email ID gets priority access): https://www.datamintelligence.com/download-sample/orphan-drugs-market

Market Segmentation

DataM Intelligence breaks the orphan drugs market into key segments:

By Drug Class:

o Chemical Entities

o Biologics

o Gene & Cell Therapies

By Therapeutic Area:

o Oncology (largest share; >50%)

o Neurology

o Metabolic Disorders

o Genetic Diseases

o Others

By Distribution Channel:

o Hospital Pharmacies

o Retail Pharmacies

o Specialty Clinics

Biologics dominate by value, while gene and cell therapies exhibit the highest growth rates driven by breakthrough designations.

Key Players

Major participants in the orphan drugs arena include:

• Genzyme (Sanofi) – Pioneering enzyme replacement and gene therapies.

• BioMarin Pharmaceutical – Leader in rare metabolic and genetic disorder treatments.

• Alexion (AstraZeneca) – Focused on complement mediated diseases.

• Sarepta Therapeutics – Duchenne muscular dystrophy gene therapies.

• Amicus Therapeutics – Lysosomal storage disorder enzyme enhancements.

• Ultragenyx Pharmaceutical – Rare metabolic and skeletal disorder pipeline.

• Spark Therapeutics (Roche) – Gene therapy for inherited retinal diseases.

• Bluebird Bio – Lentiviral gene therapies for beta thalassemia and sickle cell disease.

These innovators leverage orphan drug incentives, market exclusivity, tax credits, and regulatory support to commercialize high impact, premium priced therapies.

Drug―Sales Value (2023) in Mn―U.S. Share

Darzalex―9,744.00― 54.16%

Trikafta/Kaftrio―8,944.70― 61.20%

Imbruvica Total―6,860.00―54.17%

Lynparza―2,811.00― 44.61%

Calquence―2,514.00―72.20%

Looking for in-depth insights? Grab the full report: https://www.datamintelligence.com/buy-now-page?report=orphan-drugs-market

Latest Investments

United States

• North American Rare Disease Startups raised USD 424 million in equity funding across 13 rounds in H1 2025, underscoring sustained investor appetite for orphan drug innovation.

• Antares Therapeutics closed a Series A round of USD 177 million on June 10, 2025, to advance its RNA based therapies for rare neuromuscular disorders.

Japan

• Bain Capital acquired Mitsubishi Tanabe Pharma for ¥510 billion (USD 3.4 billion) in February 2025, positioning Tanabe’s rare disease franchises particularly in neurology and immuno inflammation for accelerated development and global expansion.

• J Pharma Co., Ltd. raised ¥5.77 billion (≈USD 42 million) in April 2025 to fast track development of LAT1 inhibitors potential orphan candidates for refractory biliary tract cancers advancing into a global Phase III protocol.

Regulatory & Incentive Environment

Orphan drug development is supported by:

• FDA Orphan Drug Designation: Grants seven year U.S. market exclusivity plus protocol assistance.

• PMDA (Japan) Sakigake & Orphan Designations: Accelerated review and up to 10 years’ post marketing exclusivity.

• European Commission Orphan Status: Ten year market exclusivity, fee reductions, and protocol assistance.

These incentives lower development risk and underpin robust pipeline activity over 1,000 orphan candidates are in clinical trials.

Pipeline Highlights

• Hemophilia Gene Therapies: BioMarin and Spark’s Phase III readouts in 2025 promise one time cures.

• Spinal Muscular Atrophy (SMA): Roche’s risdiplam expanding into younger cohorts; Novartis’ Zolgensma follow on programs.

• Rare Oncology: Bispecific ADCs targeting tumor specific antigens under fast track review.

• Neuromuscular Disorders: Sarepta’s next gen exon skipping chemistries moving into pivotal registrational studies.

U.S. Market Trends (2025)

• Orphan Cures Act: Recent federal legislation now exempts multi indication orphan drugs from Medicare price negotiations, incentivizing label expansions across rare diseases.

• Public–Private Partnerships: NIH’s Rare Disease Clinical Research Network funded new trials in ultra rare disorders, matching doubled industry contributions.

Japan Market Trends (2025)

• PMDA Orphan Designations Hit Record High: In 2024–25, over 100 orphan drug designations were granted the highest annual tally to date, reflecting strong pharma engagement in rare diseases.

• Orphan Products Development Support Program (OPDSP): NIBIOHN subsidized R&D costs for 35 orphan designated products in FY 2025, providing up to ¥300 million per project and tax credits to accelerate local development.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/orphan-drugs-market

Challenges & Future Outlook

Challenges:

• High Cost of Therapy: Single dose gene and cell therapies can exceed USD 2 million per patient, raising payer concerns.

• Small Patient Pools: Complex global trial logistics and enrollment timelines increase development risk.

• Regulatory Variability: Harmonization gaps across regions can delay simultaneous approvals.

Future Outlook:

Orphan drugs are evolving from niche specialty products to mainstream growth drivers. With rising rare disease prevalence, expanding genomic diagnostics, and strong public incentives, the orphan drugs market is poised to nearly double in value by 2032. Strategic investments in the U.S. and Japan further validate the sector’s promise setting the stage for transformative therapies that address critical unmet needs in rare disease care.

Unlock 360° Market Intelligence with 2 Days FREE Trial Access of DataM Subscription Now!" https://www.datamintelligence.com/reports-subscription

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Pipeline Analysis For Drugs Discovery

✅ Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Competitive Landscape

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Related Reports:

Cholesterol Testing Products Market expected to reach US$ 42.25 Bn by 2033

Drug Abuse Testing Market is expected to reach US$ 12.31 Bn by 2033

Sai Kumar

DataM Intelligence 4market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release